“First, solve the problem. Then, write the code.”

Software and Artificial Intelligence (AI) have changed our lives.

They allow us to do so much, but they are not magic. That simple thought is one of the big lessons I learned from the two legendary traders in the picture above. And when it comes to technology and trading–these questions are the norm:

Question: In your Flagship product there’s also AI/software involved, right? Can you tell me more about it?

Question: Quite often courses are sold and there is subsequent cost for alert systems or indicators etc. I want to find out if this is the case, what you use and any cost that is associated with it. I don’t mind buying it, however I want to know upfront what it is and the cost of it. This helps my financial planning.

Question: Michael, I am a big fan of your podcast. Since then I have read several of your books and started to develop a serious interest in trend following trading. I am hoping you can suggest good analysis software for identifying trends and paper trading.

My answers to follow will save you $10,000 in time and expense. Read to the end and thank me later.

Trading Technology Confusion

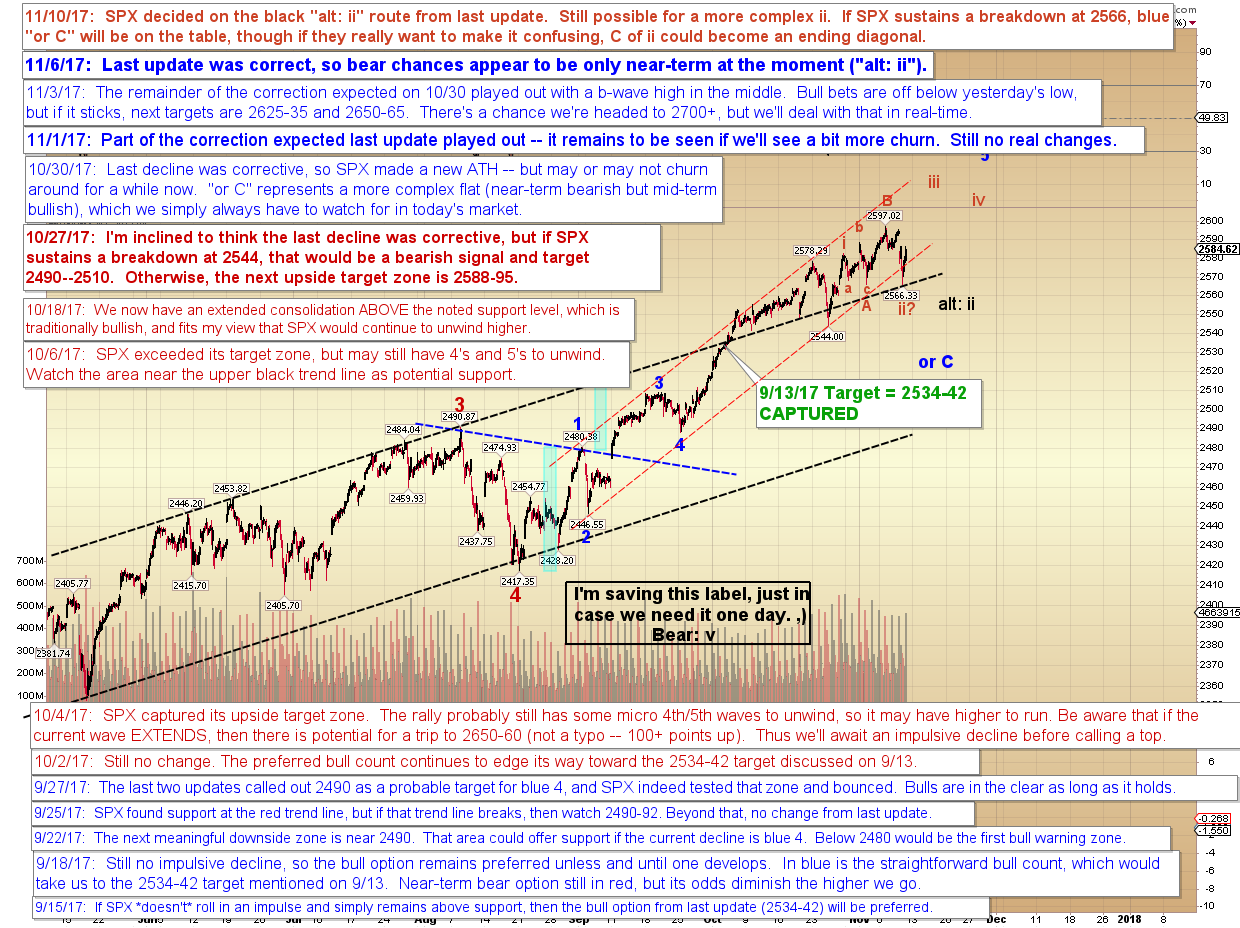

There is trading technology, software and AI everywhere. Apps, charts, indicators. Most all of it is pure mental masturbation. For example:

And consider this pearl I pulled from some chartist on CNBC recently:

Looking at a chart of [Apple he] points out what he describes as a very strong uptrend going back to the summer of 2016. Drawing a parallel channel line leads the technician to conclude that Apple could rally to meet the top line or the parallel channel, which sits at around $200. At that point, technically speaking, we would be considered overbought. But for now, we can use that for the upside target [through the end of the year].

Then come the traders who imagine their trading desk to look like this:

One reader wrote me thinking that trend following involved 30-minute bars:

“You mentioned that it is gambling staring at the computer screen the whole day–which is what I might do if use the 15-min. or 30-min. charts. And trend followers don’t do that?”

No.

Trend following is not day trading. It doesn’t involve 10 monitors on your desk.

Successful trading is not about any of that. This nonsense abounds, especially on Twitter and in Facebook forums. Successful trading is not about state-of-the-art technology or the latest and greatest trend following software. A great piece of wisdom from one of the oldest running trend followers is crystal clear:

“I’m very uncomfortable with black box trading where I’m dealing with algorithms I don’t understand. Everything we do we could do on the back of an envelope with a pencil.”

That ‘back of an envelope’ remark is a revelation for those that imagine trading to be wildly complex. Visit the office of a successful trend follower and you are in for a surprise. Their technology is not fancy. Why would you need the latest whatever app if your trades can go 6 months? Moreover, the best trend followers do not physically watch their computer screens 24 hours a day. Fancy charts, bells, or whistles won’t help you to make money.

Consider trend following legend Kevin Bruce. He did his initial trend following with a hand held calculator working nights at a gas station. How did that work out? He made himself $100 million. Bottom line, the rules themselves are always the key. Readers counter:

“No way, trend following is too complicated! I read about algos everywhere!”

Stop. If you think it’s too complicated you are either new or ignorant. Either way it’s time to change your view. Listen to David Harding’s incredulity as he explains his early lack of sophistication:

“I had a very deep understanding of the ideas involved in running trend following trading systems [and] it was very easy for me to set up. As a matter of fact, we set it all up using spreadsheets. We didn’t have any sophisticated computers, we had no computer languages.”

That revelation alone might cause the folks chasing secrets a myocardial infarction, but Harding was not done:

“In fact, we didn’t employ any programmers at all. One of my old friends, who has no training of any sort, wrote all the systems and everything on a single spreadsheet, and we were able to run [our firm] just on a spreadsheet program in Excel with three people. That spreadsheet continued in operations the next nine or ten years. (Laughter.) I’m really letting the secrets out of the bag here…”

Harding then went theoretical-physicist on the deeper meaning at play within a trend following philosophy:

“[Trend following is] much more profound than many hedge fund strategies because it’s talking about the very exploitable effect in the price movements of whole asset classes. People talk about anomalies; it’s not like some small anomaly. It’s about the way the whole world works. It’s a theory about the way the world works, which is different from the theory that everybody in the financial world has about how the world works.”

If a billionaire trend following trader puts the emphasis there…should not you? Daniel Dennett, a cognitive scientist with zero connection to trend following, compounds Harding’s insights:

“Here is something we know with well-nigh perfect certainty: nothing physically inexplicable plays a role in any computer program, no heretofore unimagined force-fields, no mysterious quantum shenanigans, no élan vital. There is certainly no wonder tissue in any computer. We know exactly how the basic tasks are accomplished in computers, and how they can be composed into more and more complex tasks, and we can explain these constructed competences with no residual mystery. So although the virtuosity of today’s computers continues to amaze us, the computers themselves, as machines, are as mundane as can-openers. Lot’s of prestidigitation, but no real magic…All the improvements in computers since Turing invented his imaginary paper-tape machine are simply ways of making them faster.”

Can-openers? You bet. That said, I know the charts look so cool…

Let’s Get More Granular

Trading legend Larry Hite (see here) would much rather have one smart guy working on a lone Macintosh than a team of well-paid timekeepers with an army of supercomputers. However, Hite is adamant the real key to using computers successfully is the thinking that goes into code. When someone asked him why go the computer route when people power is so important, he replied:

“Because it works–it’s countable and replicable. I’m a great fan of the scientific method. And the other things are not scientific. If I give you the algorithms, you should be able to get the same results I did. That to me means a great deal.”

However, technology can over-optimize or curve-fit a trading system to produce something that looks great on paper alone. Barbara Dixon, a Donchian student, notes:

“When designing a system, I believe it’s important to construct a set of rules that fit more like a mitten than like a glove. On the one hand, markets move in trends, but on the other hand, past results are not necessarily indicative of future performance. If you design a set of rules that fit the curve of your test data too perfectly, you run an enormous risk that it will fizzle under different future conditions.”

A robust trading system, one that is not curve-fit, must ideally trade all markets at all times in all conditions. Trend following parameters or rules must work across a range of values. System parameters that work over a range of values are considered robust. If the parameters of a system are slightly changed and the performance adjusts drastically, beware. For example, if a system works great at 20, but does not work at 19 or 21, that system is not robust. On the other hand, if a system parameter is 50 and it also works at 40 or 60, the system is much more robust and reliable.

Trend trader David Druz has long championed robustness in trading systems. He dismisses trades of short-term traders who fight for quick hitting, arbitrage-style profits as pure noise. Traders who focus on short-term trading often miss the longer-term trends–those trends where long-term trend following often bags its biggest opportunities. To wait like that, you need complete faith in your trading system. Barbara Dixon warns:

“Contemporary databases, software, and hardware allow system developers to test thousands of ideas almost instantaneously. I caution these people about the perils of curve fitting. I urge them to remember one of their primary goals is to achieve discipline, which will enable them to earn profits. With so many great tools, it’s easy to change or modify a system and to develop indicators rather than rules, but is it always wise?”

It is easy to get caught up in the AI hype. Advertisements run nonstop everywhere promising instant riches. Fancy charting software will make you feel like Master of the Universe, but that is false security. When describing his early trading successes, John W. Henry made clear it was philosophy, not technology:

“In those days, there were no personal computers beyond the Apple. There were few, if any, flexible software packages available. These machines, far from being the ubiquitous tool seen everywhere in the world of finance and the world at large today, were the province of computer nerds…I set out to design a system for trading commodities. But things changed quickly and radically as soon as I started trading. My trading program, however, did not change at all. As I said, it hasn’t changed even to this day.”

One of Henry’s long-time associates elaborates:

“Originally all of our testing was done mechanically with pencil and graph that turned into Lotus spreadsheets, which was still used extensively in a lot of our day to day work. With the advent of some of these new modeling systems like system writer, day trader and some of the other things, we’ve been able to model some of our systems on these products. Mostly just to back test what we already knew, that trend following works.”

And Richard Donchian makes clear the time needed to execute successfully as a trend following trader:

“If you trade on a definite trend following, loss-limiting method, you can trade without taking a great deal of time from your regular business day. Because action is taken only when certain evidence is registered, you can spend a minute or two per market in the evening checking up on whether action-taking evidence is apparent, and then in one telephone call in the morning, place or change any orders in accord with what is indicated. Furthermore a definite method, which at all times includes precise criteria for closing out one’s losing trades promptly, avoids…emotionally unnerving indecision.”

That’s why software and technology will cost you $10,000 in expense and time if done wrong.

Action Steps

Now let’s talk the automation and tracking of trend following rules. There are choices. And there is no one size fits all:

- You can trade trend rules by pencil on a paper spreadsheet. Not optimal, but it works.

- Many great traders still use home grown Excel spreadsheets to track their trading.

- There are innumerable 3rd party apps with tons of bells and whistles. You don’t need more than Excel level automation, but 3rd party apps like Tradestation can be used. However, keep in mind most of their features will be akin to MS-Word, stuff you never use.

This is really about cars. There are fancy cars and not so fancy cars. In trend trading both cars can get you to the same place. If you think you need leather seats, go for it. If you don’t care about that, great too.

Software and AI are tools–that’s it. Rules, systems, psychology and philosophy…all come before software or automation. It’s the before where I help investors the most.

Ask yourself, “What do you want?” It’s either shooting for the big profits or bells and whistles completely unrelated to profits. It’s a choice. My Flagship product does not include software or AI hype–now you know why. However, do I help clients with understanding their software options for their unique situation?

You bet.